4 min read

If you’re buying a new or certified used ride you can count on one thing: it’s only a matter of time before the sales rep at the dealership offers you an extended warranty. It sounds great, right? Long-term protection for your shiny new cruiser. Peace of mind after a big new purchase. But is it really worth the extra bucks? Let’s take a closer look

what is an extended warranty?

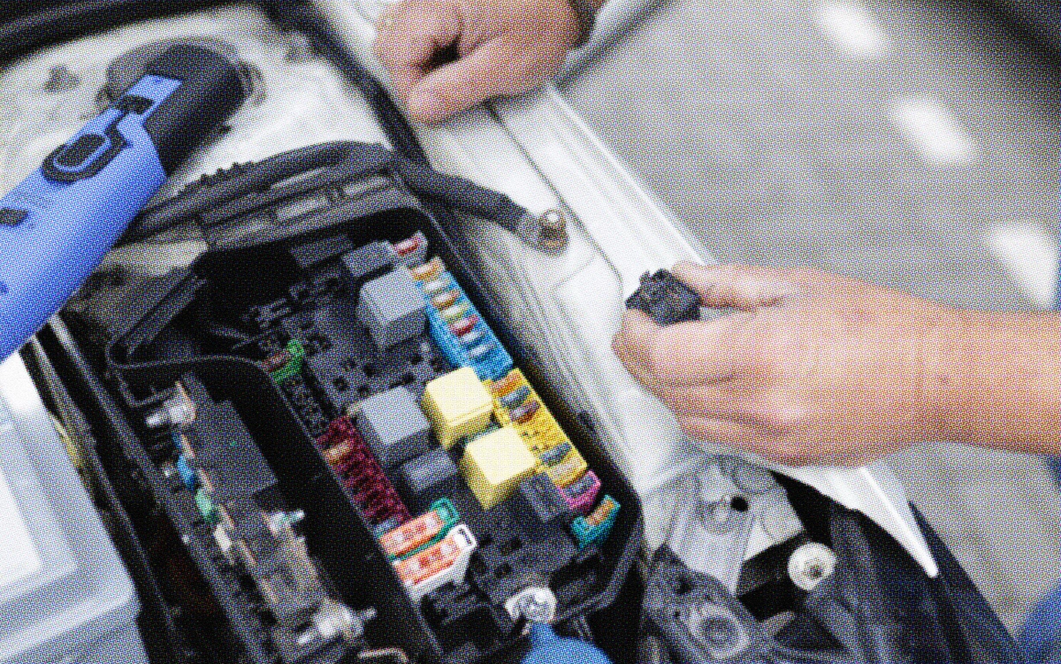

All new cars come with a basic manufacturer warranty. This will cover major breakdowns or faults in the car's main parts—and if a model gets a recall—but sometimes it can be more comprehensive, covering all the parts in the car apart from damage due to wear and tear.

An extended warranty gives you third party coverage even when that expires. It’s a bit like taking out insurance in case any of your car’s major parts break down—like the engine or transmission. It usually includes some useful extras, like roadside assistance, or coverage for a rental car while yours is getting repaired.

how much does an extended warranty cost?

It usually starts at around $1000 and can go way up to $4000 depending on the level of coverage and how long you want it for. You might need to pay a deductible for each claim, and contribute a fee towards repair costs.

pros to getting a warranty

If your car breaks down you could save a lot of money. Particularly if you need major repairs. And if you don’t have access to a savings pot, then it can feel good to know that if you have an emergency then you won’t have to worry about finding the extra bucks to get your car sorted.

cons to getting a warranty

Generally speaking, it’s a big expense that usually isn’t worth it. Extended warranties are usually overpriced and take advantage of customers feeling anxious about something going wrong with their car.

Around half of people that buy one never make a claim. And unless you have a big breakdown with costly repairs, the chances are the warranty will cost more than the bill for the mechanic.

Even if you spread your warranty costs across a payment plan, you’ll still be paying more interest on the total deal.

is there another way?

If you want to get some peace of mind (without forking out on extra coverage) then the sensible thing to do is organize your own warranty.

Set up a savings pot just for car repairs and transfer a set amount each month in case of an emergency. There’s a decent chance you won’t need to spend it, in which case you can spend those extra bucks on something special. Trust us, it’s a lot more fun spending your wages on tickets to a game, or a romantic dinner than signing over an extra $1000 for something you might never use. Alternatively, take a look at extending your regular car insurance policy—it could deliver a better deal on similar cover.

An extended car warranty can feel like a sensible idea, but oftentimes it’s just not worth it. Whether your vehicle is covered by a warranty or not, if it breaks down you might be wondering if it's time to repair or sell your car.

Here at Peddle we don’t care if your car is shiny new, or a total hunk of junk. We’ll give you an instant offer and send someone right away to come and collect it—and hand you a check.

Over 146k five-star reviews

Frequently Asked

TOP NOTCH CUSTOMER SERVICE

HOW CAN WE HELP?

Smooth operators are standing by with answers so you can sell your car without a hiccup.