3 min read

Car insurance. Boooring, right? Well, until your car has had too much excitement, like backing into a fire hydrant and smashing your bumper. Now it’s time to put on your reading glasses and look closer at your insurance policy. What cover exactly did you sign up for all those years ago? And what’s the deductible? What even is a deductible?

We know, we know, insurance details are dull as, but let’s take a minute to get you (and your car) back on track.

how do insurance deductibles work?

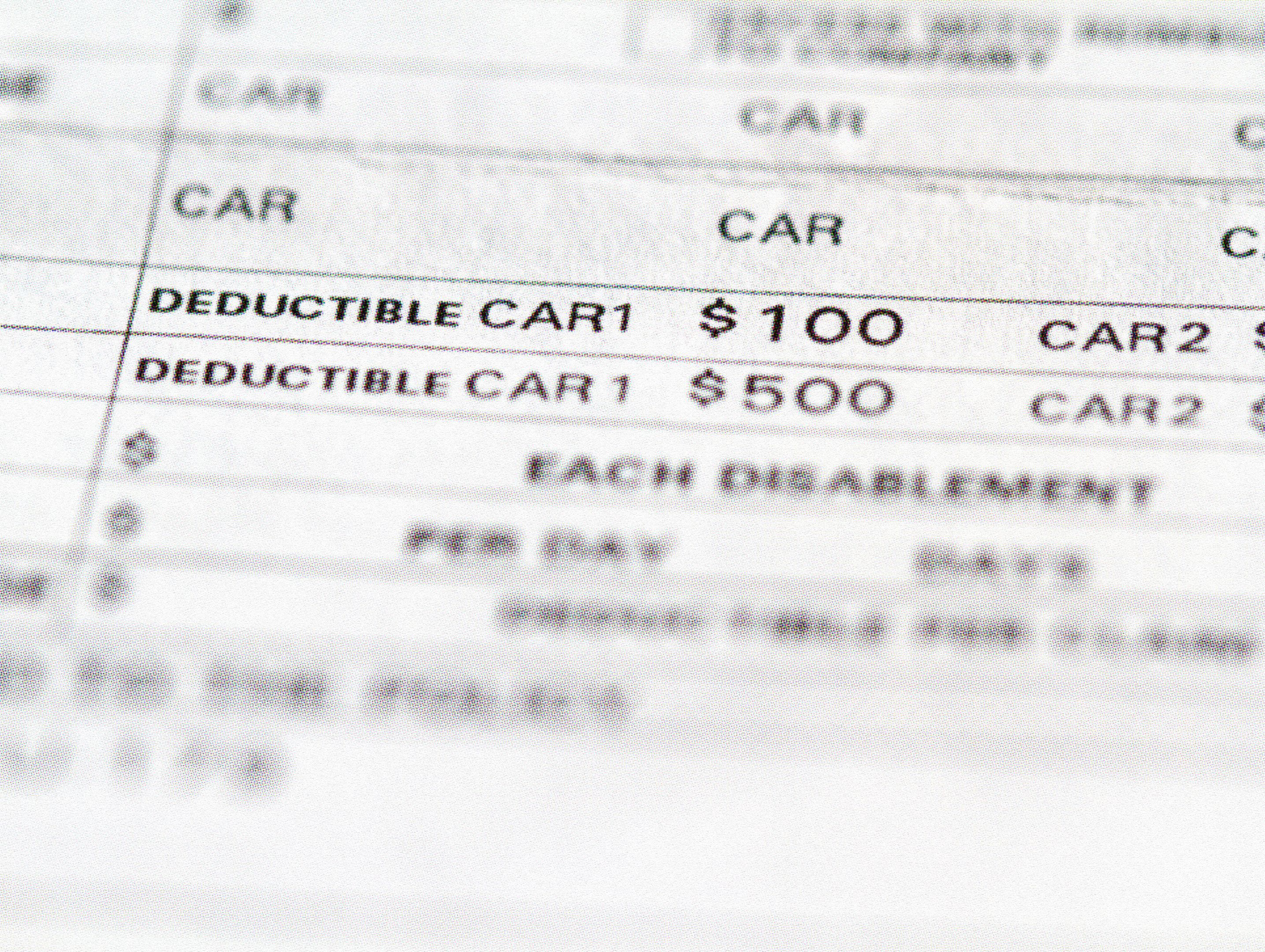

Your auto insurance deductible is the amount of money that needs to come out of your own pocket for each claim. The amount will depend on the type of insurance you bought, but typically ranges from $500-1000.

A high deductible usually means you’ll pay a lower rate, and a low deductible equals a higher rate. Fortunately you don’t have to pay it up front, it gets subtracted from the payout, but you’ll need to factor this into any repair costs.

For example: your busted bumper. Let’s say that it costs six hundred bucks to repair and you have to pay a deductible of $500. You’ll only receive $100 for the claim and have to pay the rest yourself.

It makes your insurance policy seem pretty measly right? But If you end up in a total fender bender, and the claim runs into the thousands—or you need a new car–then forking out the first $500 suddenly seems like a pretty sweet deal.

is it always worth making a claim?

This, amigo, is the million dollar question (or at least the $500 question!). With any car insurance claim you’ve got to figure out if it’s worth filing it in the first place.

If your claim is for a $200 repair but your deductible is $500 then there’s no reason to file a claim. That’s a no brainer right?

Even if your repair costs are a couple of hundred dollars higher than the deductible, you should still weigh up if it’s worth making a claim, as it could push up your rates when you come to renew your policy.

what happens when the deductible is worth more than the value of my car?

In some cases—particularly if you’re rolling around in an old timer—then the deductible is higher than the value of the car itself. And this is more likely to happen if you have a higher deductible in the first place.

In this situation any insurance claim would count as a “total loss” and can mean the end of your policy.

If that’s the situation you’re stuck in, it may be time to free yourself from that hunk of junk and move on up to a roadworthy ride.

Insurance claims are a bummer, but nothing can lighten your day like making some quick cash from a broken down motor. And that’s where Peddle comes in. We’ll make you an offer for your old car in minutes and get you on the way to buying a new one.

Related articles

Finally retiring old-trusty? Get an offer in minutes-it's easy as pie